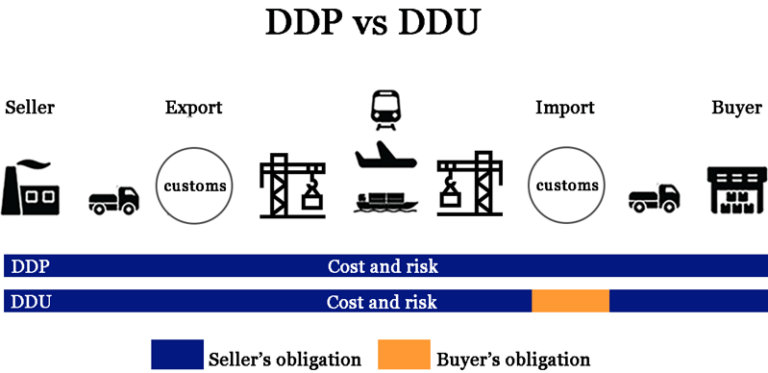

As a professional freight forwarder, I often encounter clients' confusion when choosing trade terms, especially between DDP (Delivered Duty Paid) and DDU (Delivered Duty Unpaid). Understanding the difference between these two terms is vital for ensuring smooth logistics and avoiding unexpected costs. Here's a detailed comparison of DDP and DDU from the perspective of a freight forwarder.

DDP (Delivered Duty Paid): Under DDP, the seller assumes almost all responsibilities and risks for transporting the goods to the buyer's specified location, including transportation costs, insurance, and all import duties and taxes.

DDU (Delivered Duty Unpaid): Under DDU, the seller is responsible for transporting the goods to the destination, but not for paying any import duties and other taxes at the destination.

DDP: The seller bears the highest level of responsibility and risk, including all costs and risks during transportation, as well as the destination country's duties and taxes.

DDU: The seller's responsibility ends with safely transporting the goods to the specified destination, not including payment of import duties and taxes. The buyer needs to take care of this part of the costs and the related customs clearance procedures.

Under DDP, as the seller's agent, we typically handle the complete logistics chain from start to finish, including customs clearance and paying duties and taxes.

Under DDU, as the seller's agent, our responsibility generally ends once the goods arrive at the destination country's port or airport. The buyer or their agent needs to handle the destination's customs clearance and tax payments.

DDP: Suitable for buyers who want to minimize dealing with customs and tax issues in the destination country. Buyers almost don't have to worry about any additional costs when receiving the goods.

DDU: Suitable for buyers willing to handle import processes in their country, especially those who have a clear understanding of local duties and taxes.

Choosing between DDP and DDU depends on the parties' desire for control over costs, risks, and customs processes. DDP is more suitable for buyers wanting to simplify operations and avoid the complexity of customs clearance in the destination country. DDU is better for buyers willing to undertake the responsibilities and costs associated with the importing country.

In summary, understanding the differences between DDP and DDU is crucial for international trading parties to formulate suitable logistics and customs strategies. As a freight forwarder, our task is to help clients understand these trade terms and provide corresponding logistics solutions to ensure smooth transactions while minimizing risks and costs.

Wing Shipping offers various logisticssolutions for Chinese exports, including air,sea, and rail freight. We promote tradebetween China and the world, contributingto the development of your business.

Wing Shipping offers various logistics solutions for Chinese exports, including air, sea, and rail freight. We promote trade between China and the world, contributing to the development of your business.

Copyright 2024 Wing-Shipping. All Rights Reserved.